Therefore, you do not need to have a lot of money saved up for a down payment, and can use any money that you have saved to make whatever purchases you need. In other words, down payments are not required. One of the most attractive things about securing a VA home loan is that you can finance 100% of the purchase price of a home. If you are qualified to take out a VA home loan, you should seriously consider doing so some of the main reasons include: Since being introduced, VA home loans have been quite popular and have helped thousands upon thousands of military personnel to get into affordable homes. Few parts of the bill were met with more enthusiasm than the VA home loan provisions. Bill was enormously popular and successful the many perks and benefits that it afforded to United States military personnel and veterans were the impetus for that popularity. VA Home Loans: Top Benefits And Advantages For that reason, there was no need for those who qualified for VA loans to take out private mortgage insurance - a benefit that would add up to significant savings down the line.

One of the most important aspects of how the government achieved that was by insuring the property that was being financed on the GIs' behalves. government backed up a certain portion of those loans, guaranteeing them and, essentially, vouching for those who took them out. Through the VA Loan Guaranty Program, veterans and active military personnel were able to qualify for home loans through qualified lenders. The VA Loan Guaranty Program aimed to make housing affordable for returning GIs. Considering that their lives were put on hold in many ways due to their military service, the bill was designed to give them a helping hand. Its ultimate goal was to thank those individuals for their service to their country, and to help them get on with their lives. This sweeping bill made several provisions for returning veterans of World War II. Bill of 1944 is where the VA Loan Guaranty Program originated. Here is a mortgage rate table listing current VA loan rates available in the city of Los Angeles and around the local area. Once you are in the active report view you can click the button to create a printer friendly version of your results. Once you are done with your calculations you can click on the button to bring up a detailed report about your loan. For sections that are minimized by default, please click on the dropper in the upper right section to expand them. You can also edit any of the other variables in the calculator. Set "finance the funding fee" to No and deduct that number from your cash due at closing to get your actual closing costs. If you were 10% or more disabled while in service, your funding fee can be waived. If you do not want to finance the funding fee, then set the financing option to No. If this is an additional use rather than first time use then reset that field to reflect the higher funding fee for subsequent uses. You can still enjoy a zero-down-payment VA loan as long as your available entitlement is at least 25% of your loan.If you are a reservist or a member of the guard, please change this variable to reflect your funding fee. If you have partial entitlement, the maximum VA guaranty on your combined VA loans cannot exceed 25% of the loan limit for your area. Partial entitlement means loan limits apply.

If part of your entitlement is occupied with another VA loan, and you plan to keep it there, then you have partial entitlement.

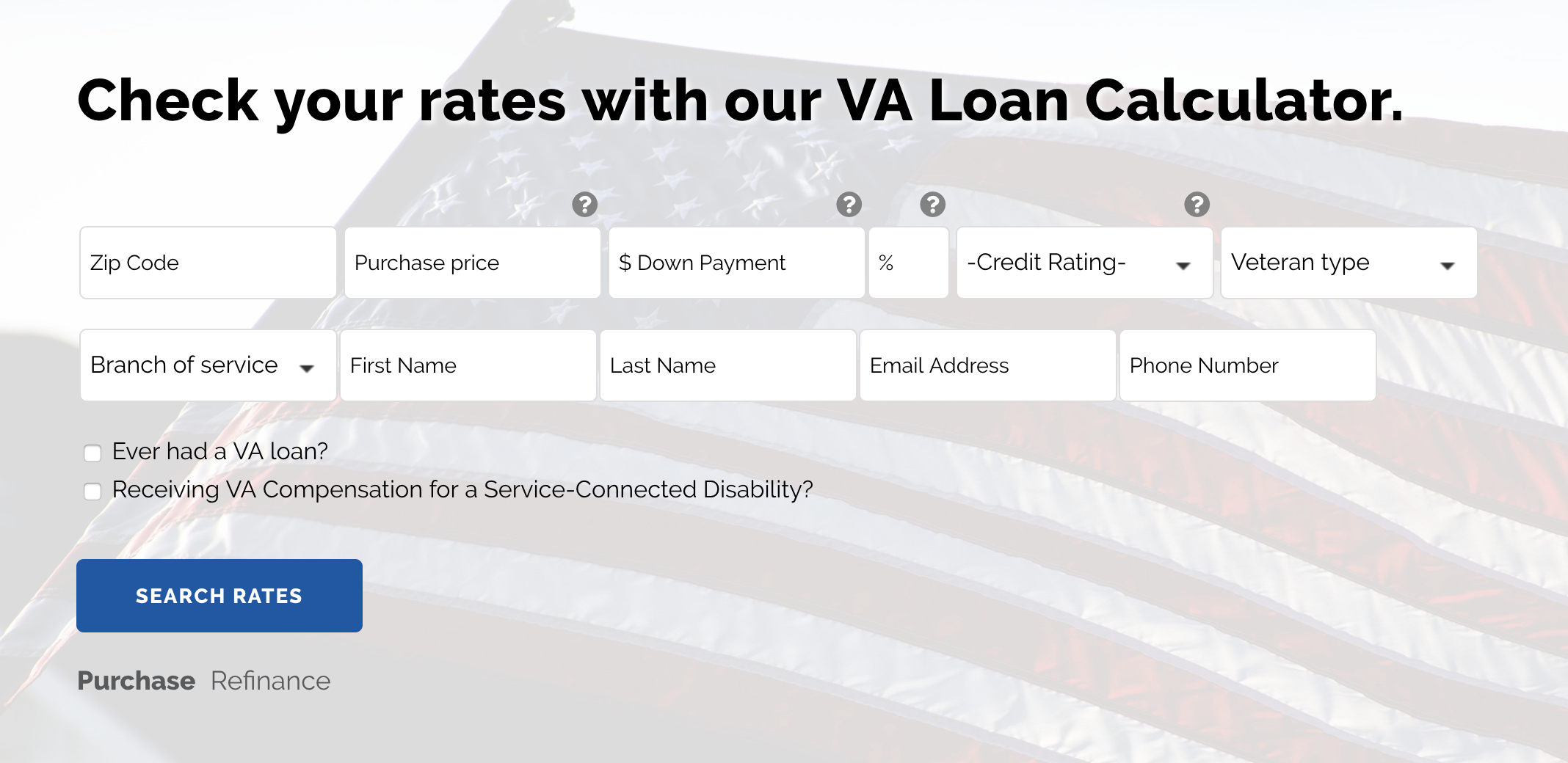

VA LOAN CALC FULL

If you have full entitlement, then loan limits do not apply to you. You may also have full entitlement if you plan to sell a home financed with a VA loan to buy another one, in which case, full entitlement can be restored before closing. Additionally, all borrowers who’ve used a VA loan to finance a home, and have since completely restored entitlement, also have full entitlement. Loan Limits Now Based on EntitlementĪll first-time VA borrowers have full entitlement. If you have full entitlement, the maximum VA guaranty is simply 25% of your loan amount - even if your loan is $1,000,000 or more. But now, loan limits are only applied to those with partial entitlement. Loan limits are defined as the maximum VA loan possible without a down payment. The act takes VA loan limits out of the equation for many borrowers. Since the Blue Water Navy Vietnam Veterans Act of 2019, more Veterans can benefit from zero-down VA loans - even in expensive housing markets.

0 kommentar(er)

0 kommentar(er)